Market Update: Falling Sales and Rising Prices 📈

The real estate market in Wisconsin has been undergoing significant changes in recent months, with falling home sales and rising prices becoming a noticeable trend. While the trend of falling home sales first emerged in the fourth quarter of 2022, it has continued into the new year. At the same time, the median price of homes that closed in January rose 8.5% over the same 12-month period.

In this article, we will explore these real estate trends in greater detail.

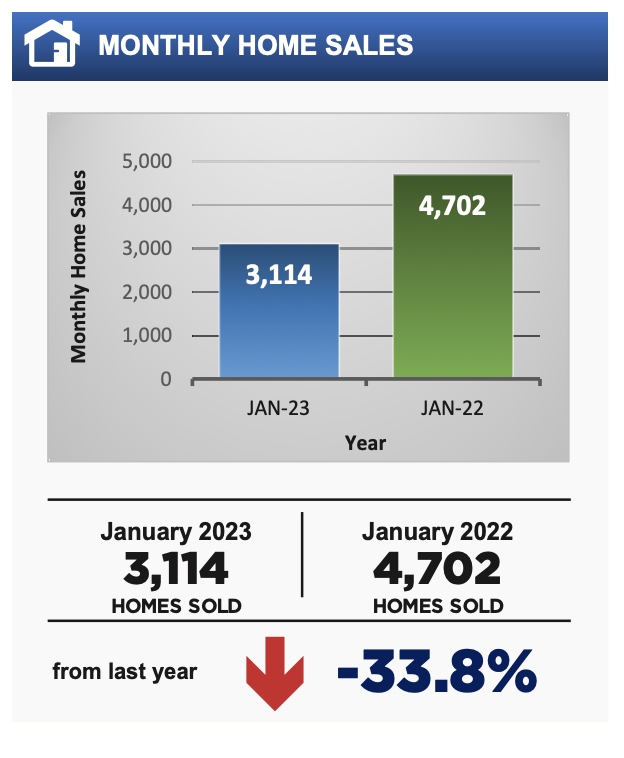

The Wisconsin real estate market saw a continuation of the trend of falling home sales in January 2023, with existing home sales dropping 33.8% compared to the same month in the previous year. The median price of homes that closed in January rose 8.5% over the same 12-month period to $250,000. This marks a significant reduction in housing affordability, which has been a primary factor in weak demand.

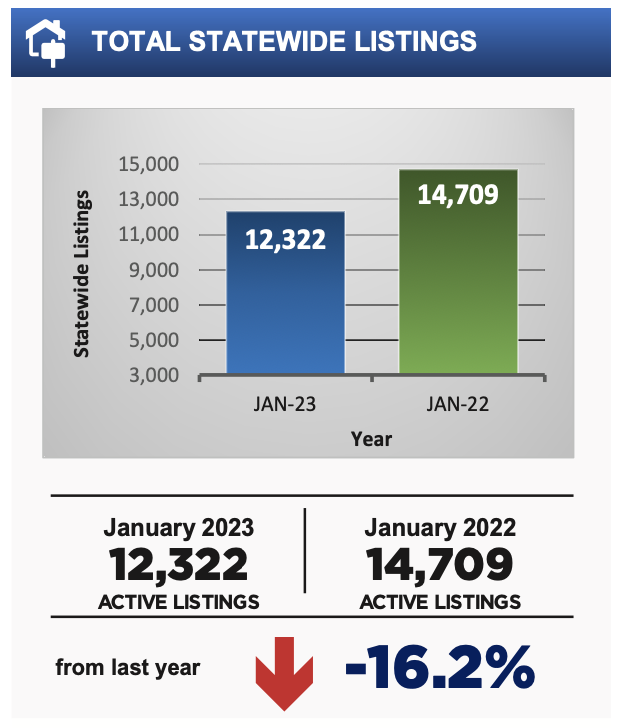

Despite the reduction in sales, inventories have remained low, with just 1.9 months of available supply, unchanged from the previous year. This lack of supply has kept upward pressure on home prices, which are still on the rise. Even the less densely populated rural areas have weak supply, with just 2.6 months of available supply.

The trend of falling home sales first emerged in the fourth quarter of 2022, with sales in the first nine months of the year down 8.8% compared to the same period in 2021, and falling by 30.1% in the final quarter of the year. While mortgage rates have fallen from their peak levels in October 2022, they remained relatively high in January 2023 at 6.27%, compared to just 3.45% in January 2022.

New listings are also down 26.2% compared to January 2022, with total listings 16.2% lower than their levels 12 months earlier. This reduction in supply, coupled with weak demand due to affordability concerns, has led to a market that is still classified as a seller’s market, with limited supply driving prices up.

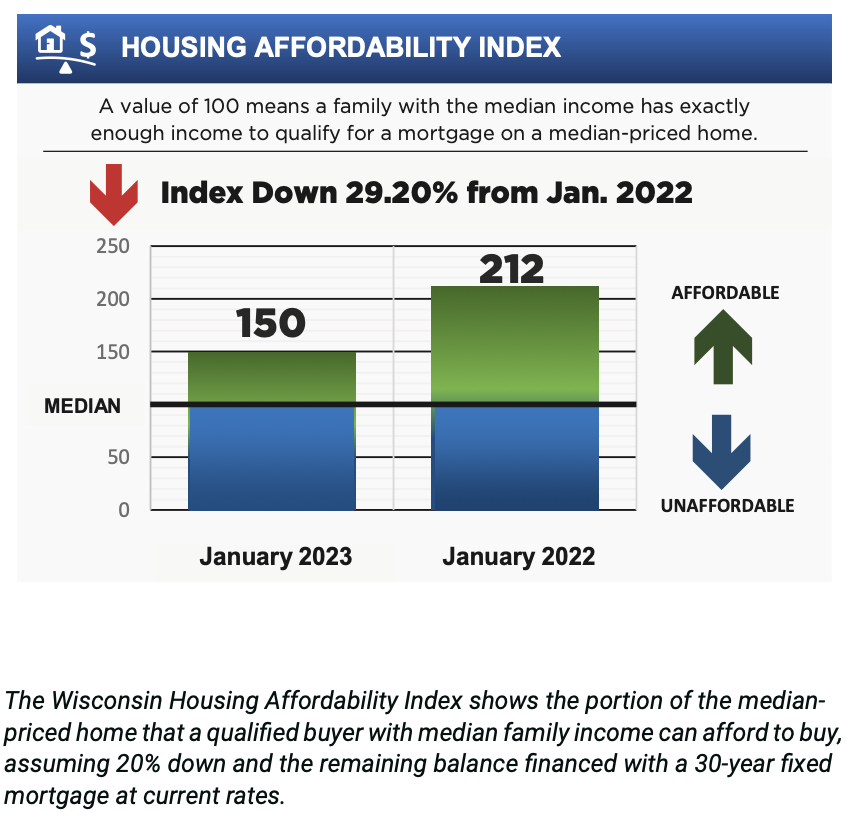

The Wisconsin Housing Affordability Index measures the percent of the median-priced home that a household with median family income can purchase, assuming a 20% down payment, and a 30-year fixed-rate mortgage at current rates financing the remaining balance.

The index fell from 212% in January 2022 to 150% in January 2023, a reduction of 29.2% over the last 12 months.

How does Dane County compare?

The median price for Dane County was $397,000, up 11.6% from $355,700 last January.

The monthly sales total for Dane County was 286, down 34.3% from 435 last January.

Months of inventory for Dane County was 1.8 months, down 5.3% from last January.

No doubt the market is facing some significant challenges, with falling home sales and rising prices creating a market that remains heavily in favor of sellers. Limited supply, coupled with affordability concerns, has created a difficult environment for prospective buyers.

Nonetheless, the market remains active, and there are still opportunities for those looking to buy or sell homes in our area. If you are considering buying or selling a home in the area, we encourage you to contact one of our agents.

With our in-depth knowledge of the local market and our commitment to delivering exceptional service, we can help you navigate the challenges of the current market and achieve your real estate goals.

Get Started Today!

We're here to help you accomplish your goals with buying or selling your home or investment property.

Hit the button below, and let's get started today.